Around this time last year, I stumbled upon a trading book called The Perfect Speculator. An almost unheard of book, it ended up becoming one of my top ten all time favourites.

The book, in my opinion, captures the essence of what it takes to become a professional stock market speculator.

The reason I mentioned this book now is because, for whatever reason, the author has decided to sell the Kindle version of the book for free. You can click on the picture below if interested:

Commodity Currencies Trend Down

The trend following system that I use has generated some new signals, which I think are beginning to form a common theme: commodities and commodity currencies are weakening.

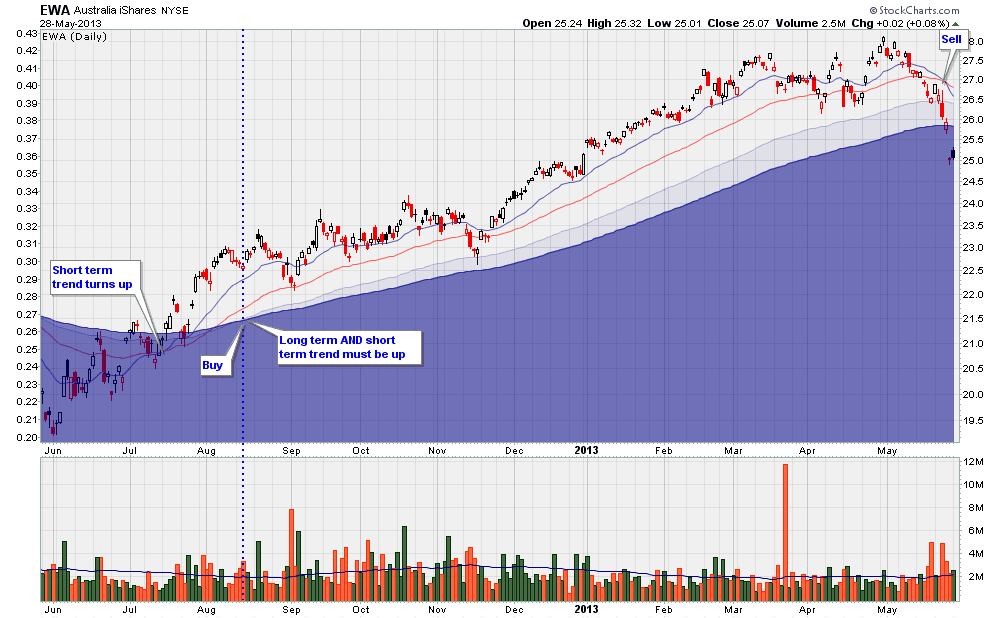

A new signal was generated for the Australia iShares ETF, ticker symbol EWA:

The chart above shows the short term trend changing, as the 20 and 50 day moving averages cross. It's pre-mature to short this market though, as the long term trend remains up.

Everything else being equal, this ETF will lose value if the Australian Dollar falls and, in fact, the Aussie as fallen about 7% this month, as the following monthly chart shows:

Similarly, the Canadian dollar is also weak. The next chart shows the Loonie entering a bearish long term down trend:

Because the long term trend has turned down and since the short term trend is also down (not shown), the Canadian Dollar is on a mechanical sell signal for me. This alone would be reason enough to short the currency (which I am).

But that's not all. The next chart shows a weekly chart of price action breaking down to a new low:

Even if you have no interest in these two currencies, I think the price action carries broader implications: money is leaving the commodities sector.

Trading with more Signal and Less Noise

The S&P 500 declined this week, but the trend remains up and no technical damage has occurred.

One mistake that I used to make in the markets was to over-react to day to day fluctuations while forgetting about the longer term trend. Now, however, I know that any one day fluctuation in the market is essentially just noise.

Below is a chart of the S&P 500 with all of the day to day price movements stripped away, leaving just the moving averages visible:

The way I see it, by smoothing out price in the the form of moving averages, what we end up with is more signal and less noise. By reducing my exit strategy to one variable, my job is easy: to continue buying and holding strong stocks for as long as the trend persists.

Speaking of strong stocks, here is a chart of a stock that I bought this week:

The stock above recently made a new all time high after consolidating for the last 6 months. That combined with what is, subjectively, a favourable chart pattern, made this stock a buy for me.

One mistake that I used to make in the markets was to over-react to day to day fluctuations while forgetting about the longer term trend. Now, however, I know that any one day fluctuation in the market is essentially just noise.

Below is a chart of the S&P 500 with all of the day to day price movements stripped away, leaving just the moving averages visible:

The way I see it, by smoothing out price in the the form of moving averages, what we end up with is more signal and less noise. By reducing my exit strategy to one variable, my job is easy: to continue buying and holding strong stocks for as long as the trend persists.

Speaking of strong stocks, here is a chart of a stock that I bought this week:

The stock above recently made a new all time high after consolidating for the last 6 months. That combined with what is, subjectively, a favourable chart pattern, made this stock a buy for me.

Trend Changes for the Dow/Gold Ratio

Last weekend, I posted some charts showing gold's collapse and also of US stocks making new highs. Interestingly, when you graph both gold and US stocks as a ratio, what you get is a major long term trend change.

The chart below shows the Dow Jones versus Gold going all the way back to 1980:

If the chart above is rising, then that means that stocks are outperforming gold. And that was the case during the great bull market lasting from the early 1980's to around the year 2000. The way I see it, this was a time of real prosperity in America.

If the chart above is falling, then that means gold is outperforming stocks, which has been the case from the year 2000 to this moment of time, right now. Arguably, this was a time of phoney growth and a bubble economy, and certainly a lost decade for stocks.

The reason I post this chart now is that it appears that the ratio is in the beginning stages of a major change of trend, as evidenced by the breaking of a downward sloping trend line. Hypothetically, if the ratio rose to 20, then that could mean $1,000 for an ounce of gold and Dow 20,000.

While it is not my intention to make any predictions, I do think that, objectively, stocks are in a major bull market, while precious metals are currently in a bear market.

The chart below shows the Dow Jones versus Gold going all the way back to 1980:

If the chart above is rising, then that means that stocks are outperforming gold. And that was the case during the great bull market lasting from the early 1980's to around the year 2000. The way I see it, this was a time of real prosperity in America.

If the chart above is falling, then that means gold is outperforming stocks, which has been the case from the year 2000 to this moment of time, right now. Arguably, this was a time of phoney growth and a bubble economy, and certainly a lost decade for stocks.

The reason I post this chart now is that it appears that the ratio is in the beginning stages of a major change of trend, as evidenced by the breaking of a downward sloping trend line. Hypothetically, if the ratio rose to 20, then that could mean $1,000 for an ounce of gold and Dow 20,000.

While it is not my intention to make any predictions, I do think that, objectively, stocks are in a major bull market, while precious metals are currently in a bear market.

Rumours of Trend Following's Death are Greatly Exaggerated

Last October when trend following giant, John Henry, decided to close up shop, there were rumours circulating that perhaps trend following as a strategy was dead.

I distinctly remember corresponding with another trend following trader, from England, saying that if I had to guess, this event may act as a contrarian signal that would lead to large gains for trend followers, similar to 2008.

And since last November, there are have indeed been some truly extraordinary trends in a wide variety of markets. Using my quadruple moving average system, the foundation of all of my charts, would have generated some clear, objective and profitable trading signals. Below are a few examples:

The chart above shows the Russell 2000. A buy signal was generated near the beginning of December and, since then, the index has blasted higher, much to the frustration and embarrassment of the vast majority of other bloggers out there who have tried to call a top in this market.

The great thing about being a top picker is that you will always end up being right, eventually. The downside, however, is that tend they to lose money over the long run, which is likely why they have to resort to selling newsletters, or cover their website with annoying ads, whereas trend following traders just tend to trade, in silence.

Next, we have a chart of the Japanese Yen. A black and white, unambiguous, objective sell signal was generated in mid-October.

Thirdly, a sell signal was generated in gold near the beginning of December. Since then, gold was simply not buyable for me and I have forgotten about the metal, deploying my capital in more productive areas.

To the chagrin of gold bugs, "doomers", and perma-bears, precious metals stocks have completely collapsed, with junior gold stocks down 73% since the top. Meanwhile, a trend following trader could have exited the market in an objective, emotionless manner before any serious damage occurred.

I distinctly remember corresponding with another trend following trader, from England, saying that if I had to guess, this event may act as a contrarian signal that would lead to large gains for trend followers, similar to 2008.

And since last November, there are have indeed been some truly extraordinary trends in a wide variety of markets. Using my quadruple moving average system, the foundation of all of my charts, would have generated some clear, objective and profitable trading signals. Below are a few examples:

The chart above shows the Russell 2000. A buy signal was generated near the beginning of December and, since then, the index has blasted higher, much to the frustration and embarrassment of the vast majority of other bloggers out there who have tried to call a top in this market.

The great thing about being a top picker is that you will always end up being right, eventually. The downside, however, is that tend they to lose money over the long run, which is likely why they have to resort to selling newsletters, or cover their website with annoying ads, whereas trend following traders just tend to trade, in silence.

Next, we have a chart of the Japanese Yen. A black and white, unambiguous, objective sell signal was generated in mid-October.

Thirdly, a sell signal was generated in gold near the beginning of December. Since then, gold was simply not buyable for me and I have forgotten about the metal, deploying my capital in more productive areas.

To the chagrin of gold bugs, "doomers", and perma-bears, precious metals stocks have completely collapsed, with junior gold stocks down 73% since the top. Meanwhile, a trend following trader could have exited the market in an objective, emotionless manner before any serious damage occurred.

Three More Stocks Breaking Out

With the Dow where it is, it's not difficult to find new stocks breaking out. Here are 3 high potential stocks that are making new all time highs, yet exhibit excellent pattern pressure and that, I think, have potential for a lot more upside:

Because I try, as often as possible, to put my money where my mouth is, I do now own these 3 stocks. And they replace 3 older positions that were either weak, or were showing signs of relative weakness.

Because I try, as often as possible, to put my money where my mouth is, I do now own these 3 stocks. And they replace 3 older positions that were either weak, or were showing signs of relative weakness.

Learning from Old Traders, not Bold Traders

I mentioned a few weeks ago that a major problem with books written on trading is that, in general, they are not written by successful traders. Often, these books prove to me what doesn't work, which is moderately helpful, since this process will eventually lead to what does work.

However, if you want to cut to the chase, here is a suggestion: study, learn from old traders. The way I see it, if a trader has been trading for say, 25 years, he's doing something right. Furthermore, old traders are more likely to have become successful through skill, rather than luck. Anybody can put together an amazing one year track record (even me), but it's the truly skillful traders that deliver results decade over decade.

So, in this post, I've assembled some resources that I have found insightful from five old traders that I've personally learned a lot from:

However, if you want to cut to the chase, here is a suggestion: study, learn from old traders. The way I see it, if a trader has been trading for say, 25 years, he's doing something right. Furthermore, old traders are more likely to have become successful through skill, rather than luck. Anybody can put together an amazing one year track record (even me), but it's the truly skillful traders that deliver results decade over decade.

So, in this post, I've assembled some resources that I have found insightful from five old traders that I've personally learned a lot from:

1) Peter L. Brandt

Trading experience: 40 years

Website: Yes

2) William Eckhardt

Trading Experience: 40 years+

Website: Limited

Book: None, but profiled in The New Market Wizards

Other: Month by month track record

3) Larry Hite

Trading Experience: 40 years+

Website: Limited

Book: None, but profiled in Market Wizards and Trend Following

Other: Limited - YouTube Clip

4) Ed Seykota:

Trading Experience: 40 years+

Website: Yes

Book: Yes, but out of print; profiled in Market Wizards

Other: Limited - YouTube Clip

5) Nick Radge

Trading Experience: 29 years

Website: Yes

Book: Unholy Grails

Other: Podcast; YouTube Video

Now, finally, here are some commonalities that I have identified amongst these five traders:

- They have a strong emphasis on risk management. All of these traders don't risk much more than 2% of their capital on each trade. What happens if you don't follow this rule? You'll blow up eventually, and you will not become an old trader.

- They all trade in the direction of the trend. Even Peter Brandt, who technically is not a trend follower, does appear to trade in the direction of the trend most of the time, and is a self described "buyer of strength" and a buyer of "new 13 week highs".

- They don't forecast the market. These five men have over 150 years of combined trading experience and they don't where the market is going next. If they can't do it, how likely is that you can read a book on indicators, candlestick patterns, or go visit some blog out there that will "call" the market and base your success on that?

High Potential Stocks of the Week

After running my scans this weekend, here are a few stocks that I found:

Second:

Lastly, I continue to like (and own) the stock WDAY. In what is a subtle, yet powerful pattern, I count 8 higher lows since November. That combined with a fresh all time high makes for a very bullish chart, in my opinion:

Second:

Lastly, I continue to like (and own) the stock WDAY. In what is a subtle, yet powerful pattern, I count 8 higher lows since November. That combined with a fresh all time high makes for a very bullish chart, in my opinion:

Buying Stocks at New Highs

Since I will be doing some traveling soon, I had to run my scans today rather than on the weekend. So, here are 2 stocks that are looking strong right now:

Second:

Second:

Subscribe to:

Posts (Atom)