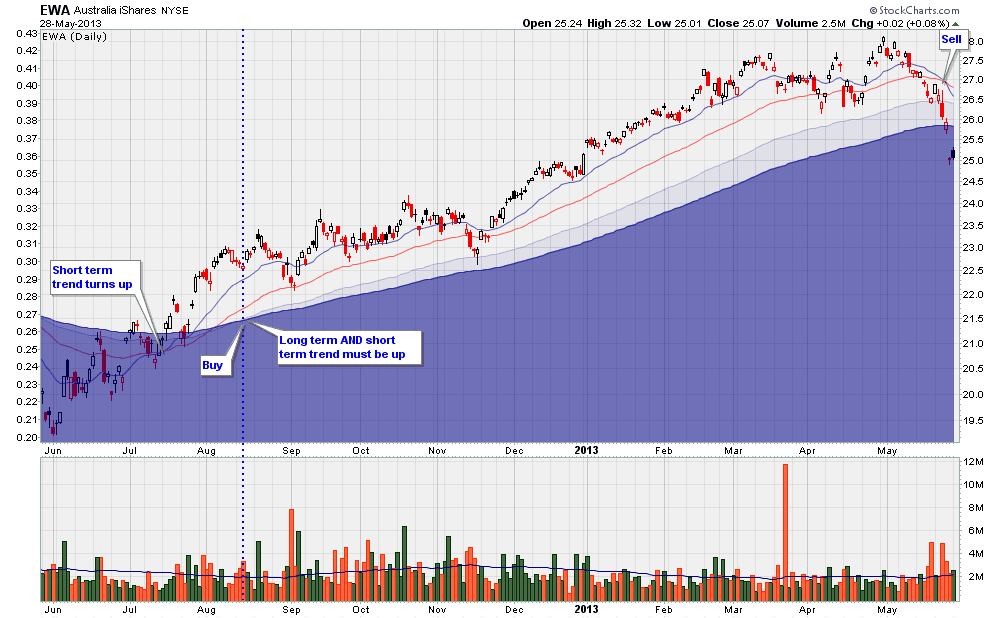

A new signal was generated for the Australia iShares ETF, ticker symbol EWA:

The chart above shows the short term trend changing, as the 20 and 50 day moving averages cross. It's pre-mature to short this market though, as the long term trend remains up.

Everything else being equal, this ETF will lose value if the Australian Dollar falls and, in fact, the Aussie as fallen about 7% this month, as the following monthly chart shows:

Similarly, the Canadian dollar is also weak. The next chart shows the Loonie entering a bearish long term down trend:

Because the long term trend has turned down and since the short term trend is also down (not shown), the Canadian Dollar is on a mechanical sell signal for me. This alone would be reason enough to short the currency (which I am).

But that's not all. The next chart shows a weekly chart of price action breaking down to a new low:

Even if you have no interest in these two currencies, I think the price action carries broader implications: money is leaving the commodities sector.