As readers of this site might have guessed, I do not have a whole lot of respect for the buy and hold investment mantra.

I do not believe in buy and hold investing even after working in the financial services sector for several years (which is built on the foundation of buying and holding), and also graduating from a business college in which students are basically indoctrinated from day one to believe in efficient portfolios,

sharpe ratios, and other pseudoscience.

But if one does not believe in buy and hold investing, what are the alternatives? After all, timing the market is very difficult, and not appropriate for retail investors. If you cannot predict the future, it is said, then is it not better to just buy and hold and expect returns over the long run?

I believe that a suitable alternative to buying and holding is a simple form of trend following. As I have demonstrated elsewhere on this site, trend following does not involve predicting the future, and I believe that it could be simple enough for retail investors.

The following is one system that I am going to start using to invest mutual funds in my own retirement account. I have mutual funds in my retirement account that can be switched every month without fees, so I have developed a system that should rarely give two signals in one month.

The system requires a daily chart of the S&P 500, 2 moving averages, and these rules:

- If the 20dma is above the 50dma, then hold an equity index fund

- If the 20dma is below the 50dma, then hold a bond fund (or an inverse fund or T-Bill fund)

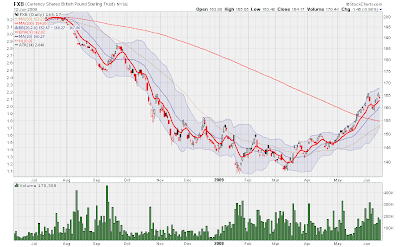

Here is an example of how this system performed for the past year:

The chart above has an indicator, but is not entirely necessary, as it only shows the crossovers more clearly. The core idea is that you hold a bond fund when the blue line in beneath the red line, and hold a index fund when the blue line is above the red line. It cannot get more simple.

Here is how the system looked in 2006:

Notice that in a strong market, you are long most of the time. I don't mind buying and holding if the trend is up. However, buying and holding in a falling market, like in 2008, is insanity, and completely unnecessary.

Here is a look in the mid 1990's:

As the above chart shows, a buy and hold investor may have been slightly better off than a trend follower, but not by much. A trend follower still would have been long about 90% of the time in 1996, and would have had an excellent year.

Here is a look at the same system in the mid 1980's:

The above chart shows that a trend follower would have been long most of 1987, as the market was rising, but weakness in October would have caused a trend follower to switch into a bond fund, thus avoiding the 1987 market crash.

If you would like more detailed performance data on

these type of systems, I encourage you to read Michael

Covel's Trend Following. I have analyzed quite a lot of data in regards to simple trading systems, and I can say that historically, systems such as this have tended to produce average annual gains in the range of 11%-18% annually over the last 25 years.

It is also worth mentioning that I find it interesting that simple trend following systems, like the one shown here, consistently outperform portfolio managers who have earned

MBAs, and other designations, like the very difficult to earn

CFA designation.

To some, the fact that a system, that is simple enough that a child could use it, can beat a highly paid Wall Street investment professional with 25 years of education may be depressing. But to me, I think it is incredibly encouraging.