This post will discuss two popular

ETFs that track the price of crude oil. The implications in this post are applicable to any other type of ultra

ETF:

1)

Horizon Oil Up (

HOU): Designed to rise 2% for every 1% crude oil rises on a daily basis

2)

Horizon Oil Down (HOD): Designed to rise 2% for every 1% crude oil falls on a daily basis

Now, imagine it is the summer of 2008, and oil is trading at $147.00 a barrel. You feel oil is overvalued (whatever that means), and you feel like picking a top in the market. There are actually two options (with pros and cons) that you have at your disposal:

1) Buy HOD (the bear ETF):-would rise if oil fell (good -if your prediction is right)

-have to pay the management expense ratio (bad)

-losses are limited to your principle (good)

-compound interest works in your favour (good)

-credit risk (risk if there is problems with the

ETF provider) (bad)

2) Short HOU (the bull

ETF):

-would fall if oil fell (good- if your prediction is right)

-you get paid the management expense ratio (good)

-losses are potentially unlimited (bad)

-compound interest works against you (bad)

-no credit risk (could actually benefit in the event of financial instability of

ETF provider) (good)

So, back to oil at $147 a barrel. What are you better off doing- buying the bear

ETF or shorting the bull

ETF?

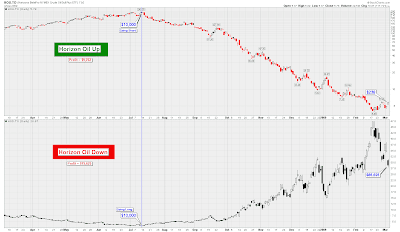

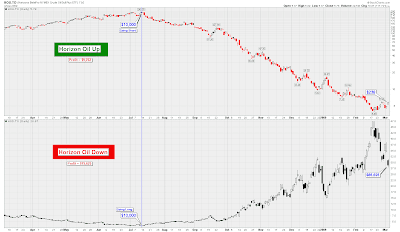

This question is answered in the following chart. We have

HOU on the top panel, and HOD on the bottom panel illustrating how a $10,000 would have fared in each

scenario:

As you can observe, simply buying the bear

ETF would have resulted in a much more profitable outcome. The main reason for this is simply because compound

interest is working in your favour when you are holding the bear

ETF, HOD.

Stated another way, compound interest works against short sellers. Also, when you are short selling, you cannot make more than your principal. The ETF cannot decline to less than zero, in other words.

Along the same topic, and to have a bit of fun, whomever first writes a comment with the correct answer to these questions will get one of my favourite trading books sent to them, in ebook format (be sure to include an email address):

1) You short a stock in a downtrend. The trend persists, and the stocks ends up falling by 80%. At this point, how much would the stock have to rally for you to lose all of your profits and return to break even?

2) You short a stock for $50.00 a share. Each day thereafter, the stock falls 5%. Assuming that the stock continues to fall 5% per day, how many days will it take for the stock to become completely worthless?

The reason I bought calls, rather than buying the ETF outright was to obtain more leverage. The above ETF, which tracks Treasury Inflation Protected Bonds, is not very volatile, and it would cost me too much margin to take a sizable position in this fund.

The reason I bought calls, rather than buying the ETF outright was to obtain more leverage. The above ETF, which tracks Treasury Inflation Protected Bonds, is not very volatile, and it would cost me too much margin to take a sizable position in this fund.

Because bond prices and bond yields are inversely correlated, it makes sense that an inverse bond ETF would have a similar chart to a bond yield chart.

Because bond prices and bond yields are inversely correlated, it makes sense that an inverse bond ETF would have a similar chart to a bond yield chart.

The above chart is a daily chart showing the Hong Kong iShares against SPY. They too are breaking out to new highs.

The above chart is a daily chart showing the Hong Kong iShares against SPY. They too are breaking out to new highs. As you can observe with the above daily relative strength chart, there is quite a trend going on. Again, to get on board this trend, one would have to buy EWM and short sell EWW.

As you can observe with the above daily relative strength chart, there is quite a trend going on. Again, to get on board this trend, one would have to buy EWM and short sell EWW.

I was filled at a price of $19.30 a share. My buy stop has been set at $21.76. Furthermore, here is a weekly chart of the same stock:

I was filled at a price of $19.30 a share. My buy stop has been set at $21.76. Furthermore, here is a weekly chart of the same stock: