The chart above looks at SPY divided by several other iShares representing countries throughout the world and goes back 3 years.

The reason I like to look at the iShares is because they are ETFs that trade in the US and are denominated in US Dollars, which makes comparison to the S&P 500 an apples to apples comparison.

Anyway, the chart above shows that the US market, for whatever reason (it doesn't matter why), is the strongest in the world.

Lastly, here are 3 stocks that my scans narrowed down this week:

This stock has recently hit not just a new 52 week high, but a new record all time high, which means to me that there is little overhead resistance. Not only that, but the stock also gapped up, and this gap, I feel, may act as support. I will be buying this stock at the open on Monday.

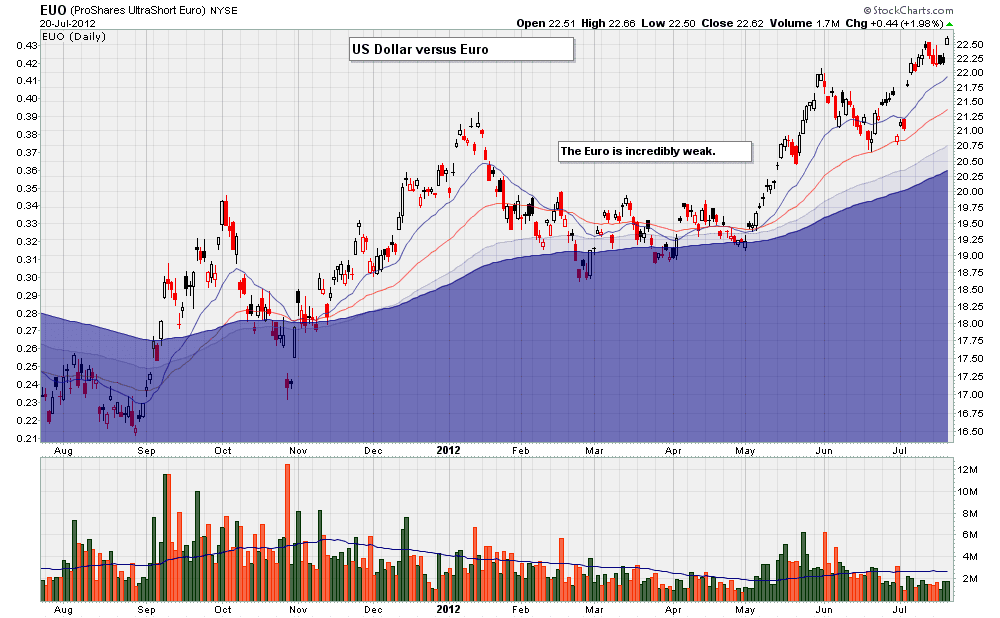

Next chart:

The chart above also looks very strong, with a constructive consolidation pattern within a larger long term up trend.

Lastly,

This ETF follows homebuilder stocks. Since last October, this ETF has been outperforming the general market and is close to making a new high.